Key takeaways:

- Finally some signs of buyer fatigue as seasonally adjusted home sales fell 20% m/m in both Toronto and Vancouver.

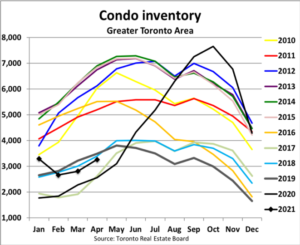

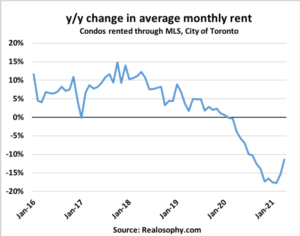

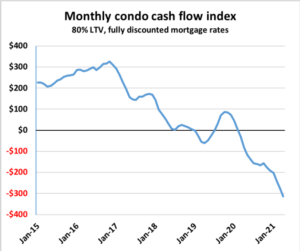

- Condo demand remains robust in major metros in spite of deteriorating cash flow fundamentals. Investors are far more optimistic about a return to 2019-level rents than we are given inbound supply and population growth that will take years to return to pre-COVID levels

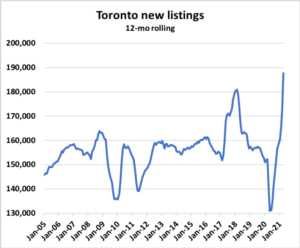

- Record new listings in several metros suggests that pent-up selling pressure may be hitting the market just as demand begins to return to more normal levels.

- This is welcome news to policy makers as it helps take some of the edge off the crazy price gains we’ve seen in recent months and provides cover for take a “wait and see” approach.

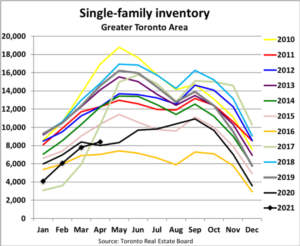

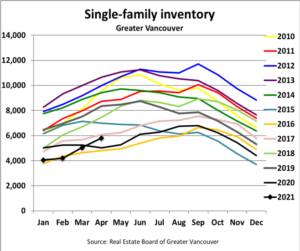

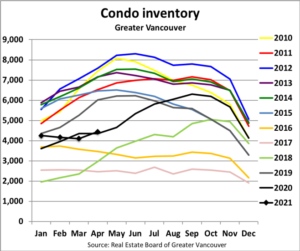

- Inventory levels remain low across segments in most major metros but are beginning to trend up off the recent lows. Still, we’ve got a long way to go to return to anything resembling a balanced market in most parts of the country.

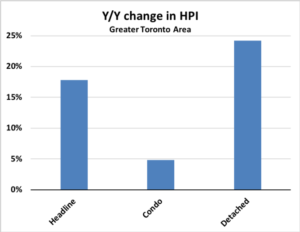

- Pricing continues to gain steam led by the perennially supply constrained single-family segment.

- Watch the Alberta metros where prices are finally accelerating after over a decade of stagnation. There’s potentially compelling value here for long-term investors if Alberta pulls off the “turnaround story” we envision.

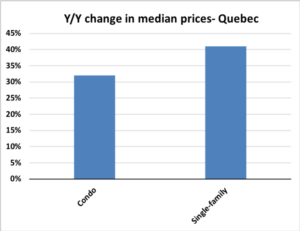

- All eyes are on Toronto and Vancouver, but don’t sleep on Quebec! Median single-family detached prices were up 41% y/y in April on account of available inventory being nearly cut in half compared to last year.

- Strong investor demand for condos has pushed prices in the city of Toronto up 9.1% in just 3 months!

Quick links:

- Toronto: Buyer fatigue sets in as sales fall 20% m/m

- Vancouver: Prices accelerate even as sales tumble

- Alberta: Price gains pick up steam

- Quebec: Median single-family prices surge 41% y/y

Toronto: Buyer fatigue sets in as sales fall 20% m/m

Seasonally adjusted home sales slumped 19.7% m/m in April, the steepest decline since the initial lockdowns last year.

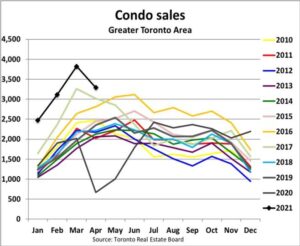

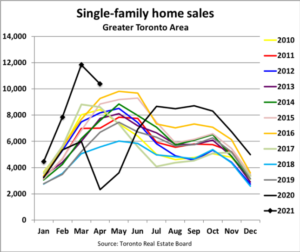

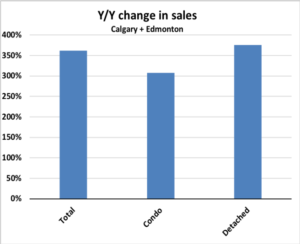

We’re now lapping the lockdown period from spring 2020 which makes for some wild y/y comps. Sales were up 359% y/y (+393% condo, +349% single-family).

Perhaps the most important dynamic to watch from here is the dramatic resurgence in new listings which came in at a record again in April, up 237% y/y (+200% condo, +251% single-family). On a 12-month rolling basis, listings have now surpassed the mid-2017 peak that saw detached prices fall 10% peak-trough across Toronto.

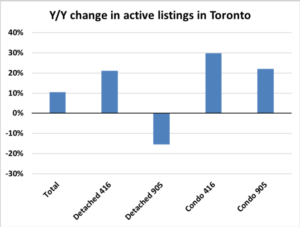

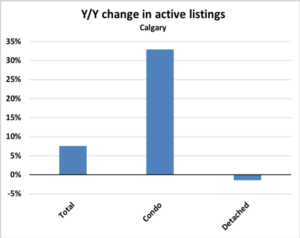

Active listings were up 10.5% y/y (+5.0% SFH, +27.6% condo) but there continues to be a notable shortage of listings for suburban (area code 905) detached dwellings:

Seasonally adjusted average resale prices fell 3.6% m/m in March. Outside of the panic in April 2020, that’s the steepest monthly decline since the foreign buyer tax was introduced to cool the market in early 2017.

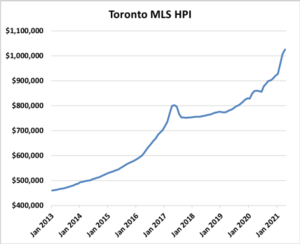

But the hedonic adjusted MLS House Price Index increased 1.7% on the month and 17.8% y/y. The previously red- hot detached slowed to just 1.0% m/m but condo prices have now appreciated 3.3% m/m for 2 consecutive months:

With the slight cooling in the market, bidding wars are becoming a bit less common, but it’s worth noting that the average sale price was 106% of list price last month, down from 107% last month but well above long-term norms. The average condo sold for 104% of list price, a figure we haven’t seen since 2017:

On that point, the blind bidding process continues to wreak havoc on pricing across the GTA. Consider an example which came within $7,000 of each other and close to his estimate of “fair value” based on recent sales. But the winning offer came in over $100,000 above the rest of the pack and now becomes the new floor for valuations in the area in spite of being 17% above any other bid:

The practice of blind bidding will continue to garner scrutiny. Consider:

The two top Remax execs call for more transparency in bidding on houses -Globe and Mail

Re/Max Canada’s two top executives are calling for more transparency in the home bidding process, and say

homebuyers should be allowed to know what their competition is offering.

The common realtor practice of blind bidding has angered buyers and is being blamed for pushing up prices in the country’s overheated real estate market. Some economists and a handful of realtors have said blind bidding needs to end.

The Re/Max executives are the most prominent voices in the real estate industry calling for changes. Re/Max is a major real estate company in Canada with a 33-per-cent market share and more than 21,000 full time licensed realtors working under its brand name here.

“We have to do right by the consumer and it is very apparent that they want reform when it comes to blind bidding,” said Christopher Alexander, Re/Max’s chief strategy officer and executive vice-president for Ontario and Atlantic Canada.

Expect this practice to increasingly be in the regulatory crosshairs in coming months. An automatic escalation clause would go a long way towards eliminating some of the “one-off” bids that come in well above the rest of the pack, but it’s no silver bullet. Australia has open auctions and the market there is just as frenzied.

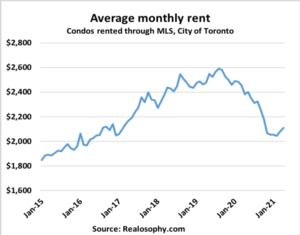

In part, the return of bidding wars on condos in the city core reflects renewed investor confidence that the reopening of the economy in the second half of the year will cause rental demand to snap back to peak levels. Rents have indeed risen for two consecutive months and show signs of having bottomed in the city of Toronto. But after accounting for the 9.1% rise in prices over the past 3 months and the ~30bp increase in mortgage rates over that time, cash flows on newly-purchased condos continue to deteriorate sharply.

The bottom is likely in for the condo rental market, but population dynamics and strong new supply flows should keep a lid on rent appreciation.

2) Vancouver: Prices accelerate even as sales tumble

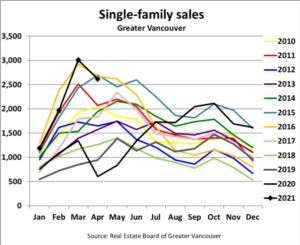

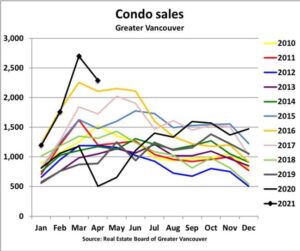

While it’s perhaps easy to attribute Toronto’s sales decline last month to new provincial lockdown measures, it’s worth noting that Vancouver also saw seasonally adjusted sales slide by ~21% m/m in April. Perhaps buyer fatigue or affordability constraints are the real culprit.

Here too the lockdowns from April 2020 make for some crazy y/y comps: Sales +343% y/y overall (+355% condo, +332% SFH)

It’s perhaps also telling that as with Toronto, we’re seeing a record number of new listings hit the market in Vancouver, up 243% y/y (+207% condo, +278% single-family):

Active inventory is back on the rise but still relatively low for now, up 9.1% y/y overall (+1.9% condo, +15.3% single- family)

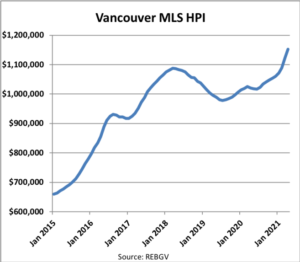

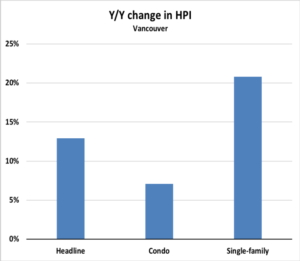

Prices continue to accelerate with the MLS HPI up 2.6% m/m building on a 3.1% increase in March. That puts the 3- month increase at 7.6%…the 2nd most rapid rate of growth on record. The aggregate HPI benchmark price is up to $1.15MM ($1.755MM for detached, $730k condo).

3) Alberta: Price gains pick up steam

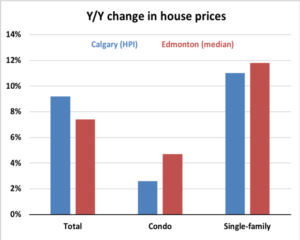

We continue to believe in the Alberta turnaround story, and we’re starting to see it reflected in house prices. Notwithstanding that the energy patch is on the mend (and we think the stories of the death of the hydrocarbon industry are dramatically overblown), there are plenty of reasons to think Alberta will fare well in coming years. Most importantly:

- Young, educated workforce

- Incredibly cheap office and commercial space

- World-class city that consistently ranks among the world’s “most liveable”

- A growing tech industry

- See: https://calgaryherald.com/business/local-business/alberta-now-home-to-3000-tech-companies- new-report-shows-an-industry-hitting-its-stride

- Very cheap housing relatively speaking

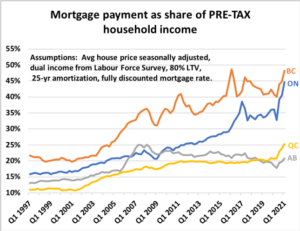

That last point shouldn’t be overlooked. High house prices do eventually become a competitive disadvantage in attracting talent. The fact that carrying costs as a share of incomes on Alberta homes are LOWER today than at any point over the past 15 years at the same time that Ontario and BC spike to 30-year highs is no small thing.

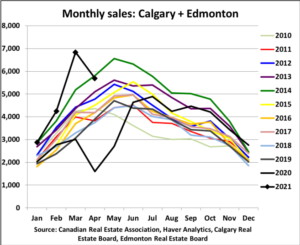

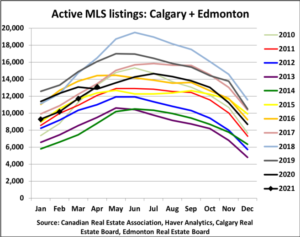

These positive fundamentals are starting to be reflected in the resale market. Combined Calgary and Edmonton home sales came in at the second highest level on record in April:

New listings rose 178% y/y helping to push active inventory up 7.6% from year-ago levels (+32.9% condo, -1.5% single-family).

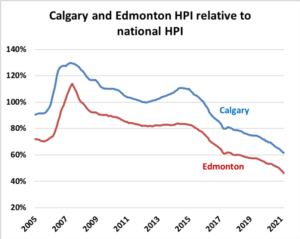

House prices are accelerating in both Calgary and Edmonton, up 9.2% and 7.4% y/y respectively. We suspect this is a trend that is only getting started. It’s easy to forget that for much of the past 15 years, Calgary house prices traded above the national average. Today they trade at only 60% of the national HPI with prices effectively unchanged over the past decade. There will be a clear catchup trade at some point, and this discount will very likely close in coming years.

4) Quebec: Median single-family prices surge 41% y/y

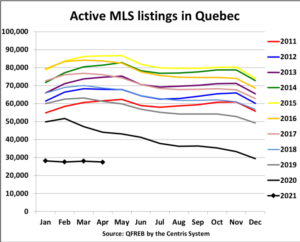

It’s hard to overstate just how hot the housing market has been in Quebec metros over the past two years. Inventory has fallen dramatically and sales have surged, driven by a recovering economy and prices that still present compelling value relative to other parts of the country.

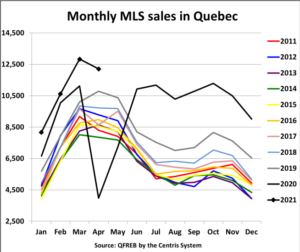

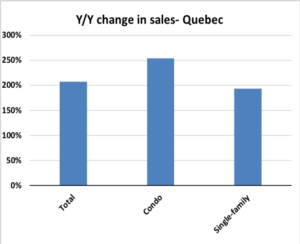

That trend was on display again in April. Home sales across the province of Quebec posted an unusually large monthly decline from March to April but were nonetheless up 207% y/y off the pandemic lows (+254% condo, +193% single-family):

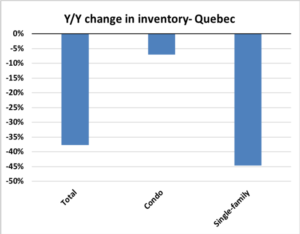

In spite of a 332% y/y rise in new listings, active inventory remains at decade lows, down -37.7% y/y with a particularly acute shortage in the single-family segment (-7.1% condo, -44.7% single-family).

Strong demand and a sharp reduction in supply has pushed median single-family detached house prices up a stunning 41% y/y while condo prices were up 32%: